FFIEC For MSPs And

MSSPs — And Their Clients

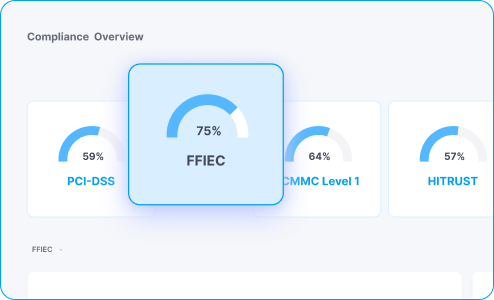

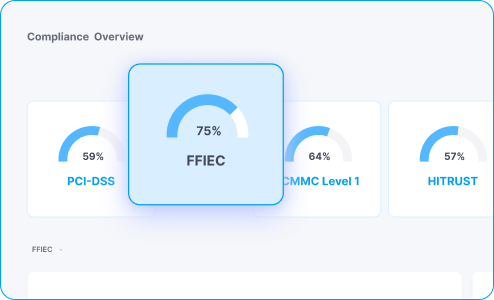

Deliver scalable, FFIEC-aligned cybersecurity services with Cynomi’s AI-powered vCISO platform. Help financial institutions meet examination expectations, reduce operational risk, and strengthen cybersecurity resilience with structured, regulator-informed processes.

What is FFIEC and Why

Does It Matter for MSPs and MSSPs?

The Federal Financial Institutions Examination Council (FFIEC) provides cybersecurity guidance for U.S. financial institutions. Its Cybersecurity Assessment Tool (CAT) and IT handbooks guide examiners and organizations in evaluating the maturity and effectiveness of cybersecurity programs.

For MSPs and MSSPs, FFIEC guidance offers a clear framework to deliver services that meet regulatory expectations. Financial institutions, including community banks and credit unions, need structured assessments, documented controls, and continuous oversight. Providers aligned with FFIEC can support compliance, strengthen resilience, and demonstrate value to regulated clients.

What Organizations Does

FFIEC Apply To?

While FFIEC is not a regulatory body itself, its standards are adopted by agencies such as the FDIC, OCC, FRB, NCUA, and CFPB. FFIEC guidance applies to:

Banks and Credit Unions

Financial Holding Companies

Mortgage and Loan Servicing Institutions

Fintech and Payment Service Providers

MSPs and MSSPs serving the financial sector

FFIEC Core Components

The FFIEC Cybersecurity Assessment Tool includes two key parts: Inherent Risk Profile and Cybersecurity Maturity. Organizations are expected to demonstrate alignment between their risk exposure and cybersecurity capabilities across five domains:

Cyber Risk Management and Oversight

Define governance, risk appetite, and cybersecurity responsibilities.

Threat Intelligence and Collaboration

Monitor threat intelligence, share data with peers, and respond to emerging risks.

Cybersecurity Controls

Implement safeguards across networks, access, data, and systems.

External Dependency Management

Assess and manage third-party and vendor-related cybersecurity risks.

Incident Response and Resilience

Prepare for, respond to, and recover from cybersecurity events.

Why MSPs and MSSPs

Should Align With FFIEC

FFIEC provides a structured framework to deliver services that align with examination expectations, reduce client risk, and drive long-term value.

Offer maturity-based cybersecurity programs tailored to financial institutions

Support documentation, governance, and control alignment for examiner reviews

Deliver standardized assessments across client portfolios

Help clients meet regulatory scrutiny with confidence

How MSPs and MSSPs Can Comply with

FFIEC and Help Clients Do the Same

Cynomi guides you step by step through managing cybersecurity and compliance.

Assess & Identify

Launch FFIEC CAT-Based Cyber Assessments

- Conduct automated Inherent Risk and Cyber Maturity assessments

- Identify gaps in governance, controls, and third-party oversight

- Generate documented risk and maturity profiles ready for exams

Establish and Plan

Build Governance and Control Programs

- Auto-generate cybersecurity policies, risk registers, and implementation plans

- Map client capabilities to FFIEC expectations by domain and maturity level

- Track responsibilities, gaps, and timelines across IT and compliance teams

Assess & Identify

Maintain Regulator-Ready Documentation and Resilience

- Monitor progress across all five FFIEC domains

- Maintain audit-ready libraries for internal and external reviews

- Support continuous improvement aligned with changing threats and exam focus areas

Framework FAQs

It’s a standardized tool to help financial institutions identify their cyber risk profile and assess their cybersecurity maturity across five key domains.

The tool itself is voluntary, but FFIEC-aligned practices are used by federal examiners during audits and reviews. Institutions not using the CAT must still meet its expectations.

Banks, credit unions, fintechs, and other institutions regulated by U.S. federal financial agencies (FDIC, OCC, NCUA, etc.) use the CAT for cybersecurity planning and examiner readiness.

It is recommended that institutions complete and update the CAT annually or whenever there are significant changes in risk profile, technology, or operations.

Cynomi automates FFIEC CAT-aligned assessments, generates documentation, tracks remediation, and maintains audit-ready records—making it easy for MSPs to serve financial clients at scale.