NYS DFS For MSPs And

MSSPs — And Their Clients

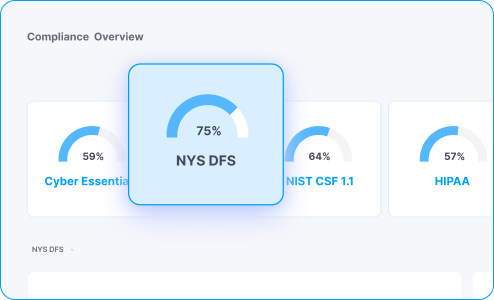

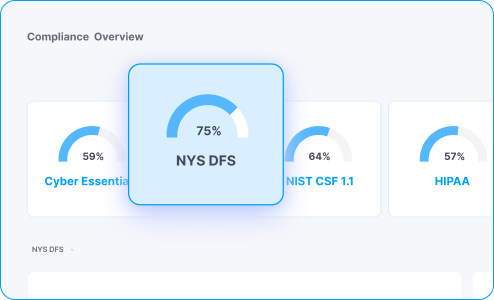

Deliver scalable, NYS DFS–aligned cybersecurity services with Cynomi’s AI-powered vCISO platform. Automate assessments, streamline documentation, and help clients meet 23 NYCRR Part 500 requirements with built-in controls and reporting.

What is NYS DFS and Why

Does It Matter for MSPs and MSSPs?

The New York State Department of Financial Services (NYS DFS) Cybersecurity Regulation (23 NYCRR Part 500) is a mandatory compliance framework for financial institutions operating in New York. It establishes minimum cybersecurity standards to protect sensitive customer data and critical operations.

For MSPs and MSSPs, NYS DFS creates a high-demand compliance opportunity. Financial institutions, insurers, mortgage lenders, and virtual currency providers need support meeting annual certification requirements, conducting risk assessments, and implementing robust cybersecurity programs. Providers that align with NYS DFS can deliver structured, audit-ready services that reduce client risk and ensure regulatory continuity.

What Organizations Does

NYS DFS Apply To?

The regulation applies to entities licensed, chartered, or regulated by the NYS Department of Financial Services, including:

Banks and Credit Unions

Insurance Companies and Agencies

Mortgage Lenders and Brokers

Investment and Financial Advisory Firms

Virtual Currency Businesses

MSPs and MSSPs supporting financial sector clients

NYS DFS Core Components

The regulation mandates a comprehensive cybersecurity program, governance model, and documentation across multiple functional areas. Key requirements include:

Cybersecurity Program and Policy

Implement and maintain a written cybersecurity policy and program approved by the board or senior officer.

Risk Assessment

Conduct periodic assessments to inform security practices and identify risks.

Access Controls and Encryption

Limit user access based on roles and encrypt sensitive data at rest and in transit.

Monitoring and Testing

Implement continuous monitoring or annual penetration testing and vulnerability assessments.

Incident Response Plan and Reporting

Develop formal response plans and report covered events within 72 hours.

Governance and Annual Certification

Designate a qualified CISO and submit annual certification of compliance to NYS DFS.

Why MSPs and MSSPs

Should Align With NYS DFS

The regulation’s complexity and high stakes create demand for specialized, structured cybersecurity services that MSPs and MSSPs are well-positioned to deliver.

Support clients in meeting evolving regulatory deadlines and filing requirements

Automate documentation, planning, and reporting for internal and regulatory use

Position as a long-term strategic partner for cybersecurity and compliance continuity

Differentiate with expertise in financial sector frameworks and controls

How MSPs and MSSPs Can Comply with

NYS DFS and Help Clients Do the Same

Cynomi guides you step by step through managing cybersecurity and compliance.

Assess & Identify

Launch Regulation-Aligned Risk and Gap Assessments

- Run automated assessments mapped to NYS DFS Section 500.00–500.23

- Identify gaps in governance, incident readiness, and data protection controls

- Auto-generate risk registers based on DFS-defined control requirements

Establish and Plan

Operationalize Policy, Governance, and Remediation Plans

- Auto-generate required documentation: cybersecurity policies, IR plans, encryption procedures, etc.

- Map remediation plans and task assignments to DFS mandates

- Prepare documentation for annual CISO reports and compliance filings

Assess & Identify

Monitor Cybersecurity Program Maturity and Certification Readiness

- Track control implementation and reporting across client portfolios

- Maintain audit-ready evidence for regulator or third-party assessments

- Support Class A entities with enhanced controls, audit tracking, and governance visibility

Framework FAQs

It is a cybersecurity regulation from the New York Department of Financial Services requiring financial organizations to implement and maintain specific security measures to protect customer data and critical infrastructure.

Any organization licensed or supervised by NYS DFS, including banks, insurers, mortgage lenders, and crypto providers, as well as business associates that handle sensitive data or systems.

Class A companies are larger covered entities (typically with $20M+ in revenue in NY and 2,000+ employees) subject to stricter requirements such as annual independent audits and advanced security measures.

Each covered entity must submit its Certification of Compliance to NYS DFS by April 15 of every year.

Cynomi automates risk assessments, policy creation, control tracking, and evidence generation aligned to NYS DFS 500.00–500.23. MSPs can manage compliance across multiple clients with audit-ready outputs and centralized dashboards.