PCI DSS For MSPs And

MSSPs — And Their Clients

Deliver scalable, PCI DSS–aligned cybersecurity services with Cynomi’s AI-powered vCISO platform. Simplify compliance, reduce manual effort, and help clients protect payment data with structured, audit-ready controls.

What is PCI DSS and Why

Does It Matter for MSPs and MSSPs?

The Payment Card Industry Data Security Standard (PCI DSS) is a global security standard designed to protect cardholder data during processing, transmission, and storage. It is maintained by the PCI Security Standards Council and applies to any organization that handles payment card information.

For MSPs and MSSPs, PCI DSS presents a consistent opportunity to deliver compliance-focused security services. Clients across retail, hospitality, healthcare, and fintech need help maintaining secure environments and demonstrating compliance to acquiring banks and card brands. Providers aligned with PCI DSS can standardize service delivery, improve audit readiness, and become essential partners for transaction security.

What Organizations Does

PCI DSS Apply To?

PCI DSS applies to any organization—regardless of size or sector—that stores, processes, or transmits cardholder data. This includes:

E-commerce Retailers

Hospitality and Point-of-Sale Providers

Healthcare and Insurance Organizations

Payment Gateways and Fintech Vendors

Franchise Operators

MSPs and MSSPs

PCI DSS Core Components

PCI DSS is organized into 12 high-level requirements grouped into six control objectives. MSPs and MSSPs play a key role in implementing and maintaining these controls:

Build and Maintain Secure Networks and Systems

Install and maintain firewalls; configure systems securely.

Protect Cardholder Data

Encrypt transmission and storage of sensitive cardholder information.

Maintain a Vulnerability Management Program

Use anti-malware and regularly patch systems.

Implement Strong Access Control Measures

Limit access to cardholder data by business need-to-know and authenticate securely.

Monitor and Test Networks

Track and monitor all access; regularly test security systems and processes.

Maintain an Information Security Policy

Establish and maintain a policy that addresses security throughout the organization.

Why MSPs and MSSPs

Should Align With PCI DSS

By aligning with PCI DSS, service providers can consistently deliver high-value security and compliance services to clients handling payment data.

Deliver control-based services aligned with the globally recognized PCI DSS framework and industry expectations

Help clients minimize risk of data breaches, fraud, and non-compliance penalties

Simplify recurring audits and reporting with centralized, ready-to-use documentation

How MSPs and MSSPs Can Comply with

PCI DSS and Help Clients Do the Same

Cynomi guides you step by step through managing cybersecurity and compliance.

Assess & Identify

Launch High-Impact Security Assessments

- Conduct automated and interactive PCI DSS – based assessments

- Instantly generate an AI-powered cyber profile and gap analysis aligned to PCI DSS

Establish and Plan

Translate Insights Into Strategic Action

- Auto-generate risk registers, remediation plans, and policies mapped to PCI DSS

- Align every task to PCI DSS

- Adapt automatically to framework and control changes

Optimize and Track Progress

Measure, Refine, and Strengthen Over Time

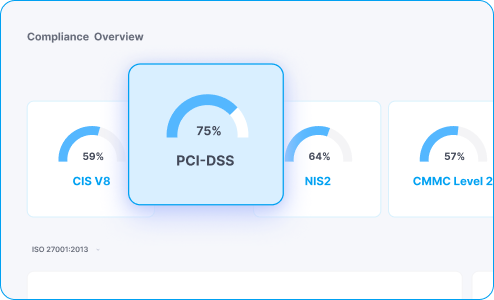

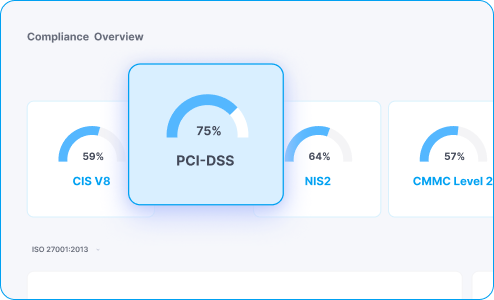

- Track real-time progress across all PCI DSS functions in one dashboard

- Maintain audit-ready documentation and reporting

Framework FAQs

PCI DSS v4.0 is the latest version, released in March 2022. Organizations must transition from v3.2.1 to v4.0 by March 31, 2025.

Any organization that stores, processes, or transmits cardholder data must comply, including merchants, service providers, and third-party processors.

Version 4.0 introduces more flexibility in implementation, stricter authentication requirements, and expanded guidance on risk-based security. It also includes several new requirements that become mandatory in 2025.

Cynomi automates PCI DSS–aligned risk assessments, generates policies, tracks control implementation, and supports audit readiness—all mapped to v4.0 requirements.

Yes. Cynomi enables MSPs to guide clients through SAQ readiness and prepare supporting evidence and documentation for Qualified Security Assessor (QSA) reviews.