PCI DSS 4.0.1 For MSPs And

MSSPs — And Their Clients

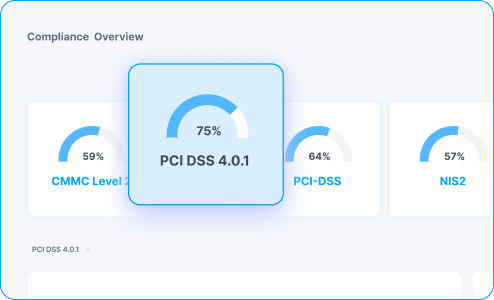

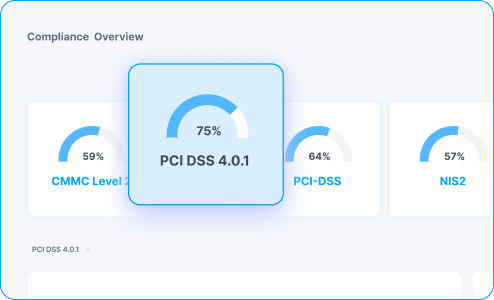

Deliver scalable, PCI DSS v4.0.1–aligned cybersecurity services with Cynomi’s AI-powered vCISO platform. Automate control mapping, streamline documentation, and help clients meet evolving payment security standards with greater efficiency.

What is PCI DSS v4.0.1 and Why

Does It Matter for MSPs and MSSPs?

PCI DSS v4.0.1 is the latest revision of the Payment Card Industry Data Security Standard, released by the PCI Security Standards Council in November 2023. This minor update clarifies v4.0 requirements and corrects formatting issues, while keeping the core structure intact.

For MSPs and MSSPs, PCI DSS v4.0.1 reinforces the need for ongoing support services across the compliance lifecycle. As merchants, service providers, and processors adjust to v4.0’s evolving requirements, providers can deliver continuous assessment, remediation, and reporting services—especially as March 2025 deadlines approach.

What Organizations Does

PCI DSS v4.0.1 Apply To?

PCI DSS applies to any organization that stores, processes, or transmits cardholder data. The v4.0.1 update applies universally to:

E-commerce Retailers and Payment Platforms

SaaS Vendors Handling Transactions

Healthcare and Hospitality Providers

Financial Institutions and Payment Processors

Franchise Operators

MSPs and MSSPs securing client CDEs

PCI DSS v4.0.1 Core Components

While v4.0.1 introduces no new technical requirements, it refines the structure and interpretation of existing ones. MSPs and MSSPs can continue supporting the 12 core requirements under six objectives:

Secure Network and Systems

Maintain robust firewalls and configurations to protect payment systems.

Protect Cardholder Data

Encrypt stored and transmitted cardholder data.

Maintain a Vulnerability Management Program

Patch regularly and deploy anti-malware solutions.

Implement Strong Access Control Measures

Use least-privilege principles and authenticate all access.

Monitor and Test Networks

Track access logs and regularly test security systems.

Maintain an Information Security Policy

Ensure policies reflect updated v4.0.1 requirements and controls.

Why MSPs and MSSPs

Should Align With PCI DSS v4.0.1

Service providers are critical to helping clients maintain PCI DSS compliance throughout changing versions and increased scrutiny.

Provide continuous compliance support across PCI DSS v4.0 and v4.0.1 requirements and updates

Help clients meet new authentication, monitoring, and documentation standards under increased scrutiny

Centralize risk tracking and audit evidence for scalable, standardized PCI DSS service delivery

How MSPs and MSSPs Can Comply with

PCI DSS v4.0.1 and Help Clients Do the Same

Cynomi guides you step by step through managing cybersecurity and compliance.

Assess & Identify

Launch High-Impact Security Assessments

- Conduct automated and interactive PCI DSS v4.0.1 – based assessments

- Instantly generate an AI-powered cyber profile and gap analysis aligned to PCI DSS v4.0.1

Establish and Plan

Translate Insights Into Strategic Action

- Auto-generate risk registers, remediation plans, and policies mapped to PCI DSS v4.0.1

- Align every task to PCI DSS v4.0.1

- Adapt automatically to framework and control changes

Optimize and Track Progress

Measure, Refine, and Strengthen Over Time

- Track real-time progress across all PCI DSS v4.0.1 functions in one dashboard

- Maintain audit-ready documentation and reporting

Framework FAQs

It’s a clarifying update to PCI DSS v4.0, published in November 2023. It includes minor edits, updated glossary entries, and improvements in formatting and interpretation. It does not add new requirements.

No. Organizations transitioning to or certified under PCI DSS v4.0 do not need separate certification for v4.0.1. The update is integrated into the existing transition path.

All organizations must fully transition to v4.0 by March 31, 2025. Some new requirements became effective in March 2024; others are considered “future-dated” until 2025.

Service providers are responsible for protecting cardholder data environments (CDEs) they manage. They must document their roles in shared responsibility matrices and support client audits.

Cynomi automates risk assessments, documentation, policy generation, task tracking, and reporting aligned with PCI DSS v4.0.1—making it easier for providers to manage ongoing compliance across clients.